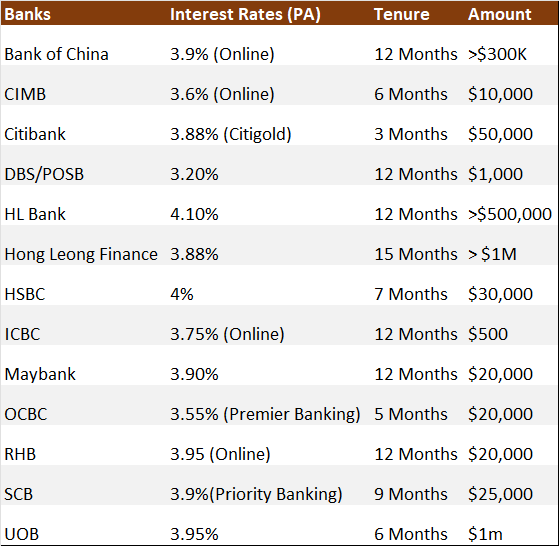

Best Fixed Deposit Rates - March 2023 Singapore

Interest rates have reached a plateau over the past few months.

Fixed deposit rates have moved within a 0.5% spread over the past few months with a trend towards the downside. The current highest rate will be 4.18% for OCBC Premier Clients.

Here are the best-fixed deposit rates for March 2023 in Singapore

Rates are as of Feb 27 2023. Please refer to respective banks for the latest

rates

Bank of China

|

| As of 20 Feb 2023 |

BOC's best rate is 4.1% for online transactions above $300K.

CIMB

See the latest rates here

SCB offers 3.9% for a 9 m placement for Priority Private Banking. For regular rates, it will be 3.7%

Citibank

Citibank only provides exclusive time deposit rates for Citigold and Citigold

Private Clients. The rate is at 3.9% for 6 months.

DBS / POSB

DBS/POSB has only recently revised the FD rates. The 12 Months interest rate

has risen from 1.7% to 3.2%.

According to their website, DBS/POSB will accept new placements for tenors 12

months and below.

HL Bank

HL Bank provides attractive rates. However, the minimum deposit starts from

$100,000. To get the highest tier at 4.1% for 6m and 12 m, you would need to

place a minimum of $500,000

Hong Leong Finance

Hong Leong Finance offers the highest rate at 3.88% for $1m for 15 months.

HSBC

HSBC offered periods of 3,7, and 12 months FD rates. The best rates will be

for 7 months at 4%. A minimum deposit will be from SGD30K.

ICBC

ICBC offers 3.75% via e-banking for deposits as low as $500. For OTC, the

minimum would be at $20,000 with 3.7% over 1 year.

Maybank

The best interest rate for Maybank is 3.9% for 12 months. The minimum

placement is $20,000.

OCBC FD rates has been reduced from a high 4.18% to 3.55% for March

OCBC also offers 8 M CPF FD at 388%. This can only be applied at the

branch.

RHB highest rate has dropped to 3.9% for a 12 or 24-month placement.

SINGAPURA FINANCE

NA

Standard Chartered Bank

UOB

UOB's best rate will be at 3.95 for 6, 10 and 12 months if you have 1 million.

For deposits less than 50K, the interest rates will be at 3.85%

Disclaimer

The information provided by TWD serves is for educational purposes. It is not meant to be personalised investment advice. Readers must do their due diligence and refer to financial advisors for their investment needs. The information is correct as of March 1 2023. Do refer to the individual banks for the latest updates.

The information provided by TWD serves is for educational purposes. It is not meant to be personalised investment advice. Readers must do their due diligence and refer to financial advisors for their investment needs. The information is correct as of March 1 2023. Do refer to the individual banks for the latest updates.

.

.png)

No comments