Top Scams in Singapore : How does it work and what you need to know to protect yourself.

Scams have been making their round in Singapore with the latest being the OCBC funds transfer scam.

In case you miss the headline, OCBC clients had fallen victim to a phishing scam with as many as 470 affected customers who lost at least $8.5 million to the scammers. This is not the only scam that is ongoing. Recently there were cases where people are lured into 'jobs' that require them to pay for products in advance for commissions. While they were paid commissions for smaller purchases, the victims would not get their money back for big-ticket items.

With so many scams going on a daily basis, it is hard to keep track. Here is a list of the common scams in Singapore

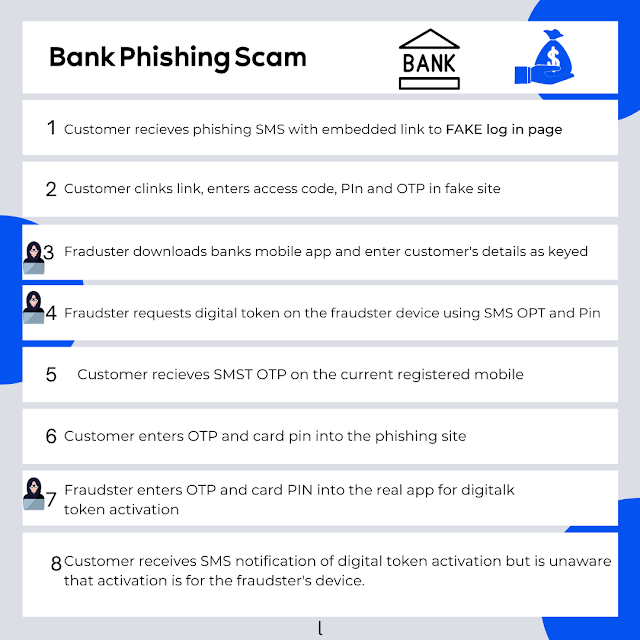

Bank Phishing Scam

Using OCBC bank as an example, here is now a scammer works.

In addition, there were some victims who failed to get SMS OTP as this could be intercepted by malware on the victim's phones or were diverted to overseas telcos that have been hacked.

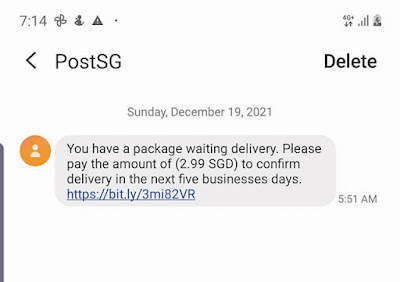

This is how a typical message may look like

|

| Source: CNA |

Other variations include unsuccessful payment, FD promotion, new login attempt warning.

How to protect yourself

As of 19 Jan, new measures had been introduced to provide customers. One of them is that banks are not allowed to transmit clickable links via SMS. As a customer, should you come across suspicious messages, call the bank's official hotline immediately to verify.

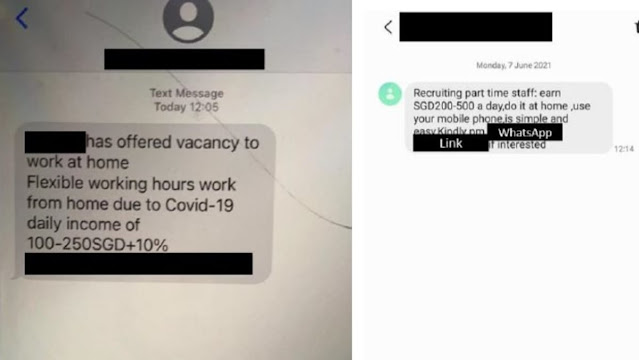

Job Scam

|

| Source: CNA |

Another common scam would be offered to work from home with a daily income of $100-$500.Victims are usually asked to place orders on e-commerce platforms and make payments to third party bank accounts to boost the merchant's online ratings. In return, they will receive a commission for their effort.

Usually, in the beginning, the victims will be paid for small tickets purchases. Subsequently, the scammers will ask for larger and more purchases. They will eventually refuse to refund for past purchases if the victim does not continue.

These offers would usually appear on SMS or Telegram. They are unsolicited.

How to protect yourself

Refrain from responding to such ads. Unsolicited requests tend to be made by scammers

Impersonator Scam

A few months ago, there had been a re-emergence of scammers posing as officers of the Singapore Police Force. Here is how it works

How to protect yourself

This is from the Singapore Police Force

-

Ignore such robocalls and the caller’s instructions. No local

government agency will contact the members of public using robocalls;

-

No local government agency will demand payment through an undocumented

medium like a telephone call or other social messaging platforms, demand

that you surrender cash to unnamed persons, or ask you for personal

banking information such as your internet banking passwords;

-

For foreign residents receiving calls from persons claiming to be

Police officers or government

officials from your home country, please call your Embassy/High

Commission to verify the claims of the caller;

-

Refrain from giving out personal information and bank details, whether

on a website or to callers over the phone. Personal information and bank

details such as internet bank account usernames and passwords, or

One-Time Password (OTP) codes from tokens, are useful to criminals. Do

not make any fund transfer(s) at the behest of such callers;

-

Call a trusted friend or talk to a relative before you act. Do not be

pressured by the caller to act impulsively; and

- If in doubt, call ‘999’ or approach a police officer at the Neighbourhood Police Centre near you.

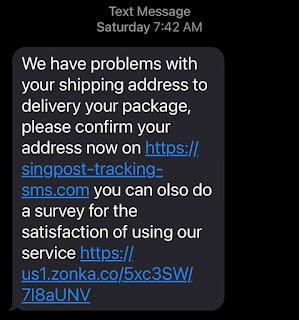

Delivery Scam

Another popular scam would be the delivery scam. You would receive an SMS that is supposedly from Singpost indicating problems with the Shipping address.

They would ask you to click on a link whereby you are supposed to provide a credit card number for payment of delivery or verification. Upon providing the credit card number, the scammers would

Other variations include a page that provides you with a tracking number to track your parcel.

How to protect yourself

With online shopping becoming a norm, it would not be uncommon to expect such messages. There are some ways to spot a scam

1) Usual Requests - especially if you have not shopped online recently

2) Spelling errors

3) Unofficial weblink

Investment Scam

The rising stock and crypto market has led many to trade. While some know what they are doing, others are just following the crowd.

Thus when someone approaches you to offer you to teach you to trade, you have to be wary. These scammers could be found on dating apps or telegram. They will first earn your trust by gaining your confidence through sweet talk and even small wins. In return, you have to invest via a dubious share/crypto website or app. Initially, you would make on your investments and would be asked to top up the funds. However, should you choose to withdraw the funds, they will impose heavy penalties like 20% fee or even stop contact altogether.

How to protect yourself

Refrain from mixing business with pleasure especially from sweet-talkers. Go for official and recognised platforms for trading.

Will scams end?

These scams are just the tip of the ice-berg. There are many scams ongoing on a daily basis. You can even check out some of the sharing on the SCAM ALERT website ( by the National Crime Prevention Council).

Scams will continue to co-exist as long as there are opportunities out there. Never let your guard down. Educate yourself on the on-going scams as well as teach your children to be wary of such scams. With children getting easy access to handphones, it is not uncommon to see such messages popping up on their phones. The best advice to them would be to delete such messages and DO NOT engage the scammers.

Just remember, if in doubt, don't do it. If unsure, don't do it.

If it sounds too good to be true, it is often not.

Stay safe!

No comments