Best Fixed Rates for August 2022 (Singapore)

Interest rates are rising in Singapore.

Housing loan rates are increasing, and fixed deposit rates are also increasing. In the past year, getting anything more than 1% is a bonus, today, you can definitely do better than that.

Here are the 10 best FD rates you can get in Singapore now.

|

Best Interest rate (p.a)

Tenure

Minimum Deposit Amount

|

|||

|

|

2.3% |

24 Months |

$5,000 |

|

|

2.25%/ 2.3%*

*Preferred Bk |

18 Months |

$10,000 |

|

|

1.3% |

18 months |

$1,000 |

|

|

2.08% |

24 months |

$50,000 |

|

|

2.43% |

30 months |

$50,000 |

|

|

2% |

12 months |

$30,000 |

|

|

1.75% |

12 months |

$500 |

|

|

2.05% |

24 months |

$20,000 |

|

|

2.2% |

25 months |

$20,000 |

|

|

2.3%/2.4%*

*Parkway Only |

24 months |

$20,000 |

|

|

2.2% / 2.3%*

*Priority B |

12 months |

$25,000 |

|

|

2.3% |

15 months |

$20,000 |

Which bank has the best rates?

For the month of August, Hong Leong provides the highest rates at 2.43%. However, it is for a period of 30 months and you need a minimum of $50,000. POSB / DBS has the lowest FD rates for this month

For over a year, SCB will have the highest at 2.2% for normal clients and 2.3% for priority clients. UOB also offers 2.3% for 15 months

Most banks now offer FD at 2% or more.

Alternative to Fixed Deposit

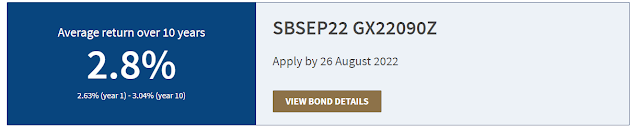

If you are looking for a conservative alternative, the Singapore Saver's Bond is a safe and flexible alternative. Although it has a tenure of 10 years, you can choose to withdraw at any time. This is more flexible than a fixed deposit. Note that there is a $2 transaction fee for application and withdrawal.

The first-year interest is at 2.63%, and it is higher than all the fixed deposit rates the banks are offering.

Disclaimer

Note that some banks will only provide these rates for FRESH FUNDS. Some banks are also offering these rates for ONLINE

transactions only. Lastly, some banks are offering higher rates for their

preferred clients only.

Do refer to the individual banks for updates. This post is NOT an offer for you to invest in. Please do your own due diligence before investing.

No comments