Singapore Budget 2023 For Families Review

Singapore Budget 2023 has been announced.

With the end of Covid-19, this year's budget will focus on rising living costs. Therefore, this review will focus on the goodies and measures directly impacting families in 2023.

For Families in GENERAL

This is part of the Budget 2023 that would benefit most households.

ASSURANCE PACKAGE (Dec 2023 onwards)

The Assurance Package (AP) aims to cushion the impact of the GST rate

increase.

AP cash will be increased by between S$300 and S$650 for eligible

Singaporeans until 2026.

Adult Singaporeans will receive between S$700 and S$2,250 in total AP cash payments over five years.

COST OF LIVING SPECIAL PAYMENT (June 2023)

A one-off Cost of Living Special Payment will be given to all eligible adult citizens aged 21 and above in 2023, with AI of at most $100,000 and those who own less than 1 property.

GST Voucher (GST Enhancement)

- If you live in a home with an annual value of S$13,000 and below: The GSTV cash quantum will be raised from S$500 to S$700 in 2023 and to S$850 in 2024.

- If you live in a home with annual values above S$13,000 and up to S$21,000: The GSTV cash quantum will be raised from S$250 to S$350 this year and to S$450 from next year.

CDC Voucher

CDC Voucher to increase by $100 to $300 per household in Jan 2024.

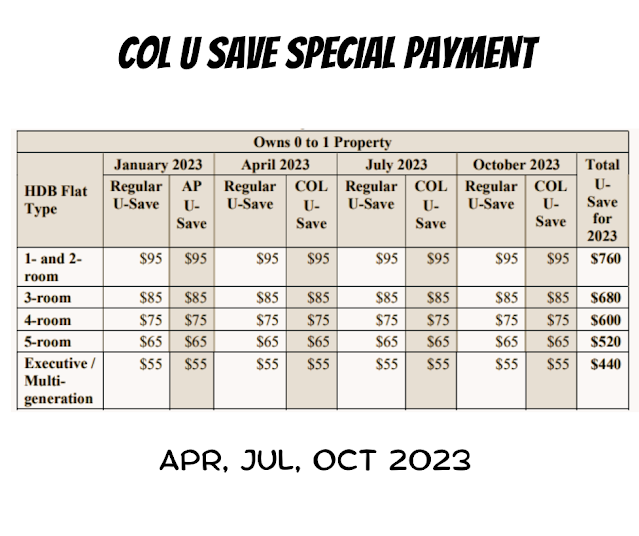

COL U SAVE Special Payment

For Families with Kids

CHILD RELIEF (1 JAN 2024)

Working Mother's Child Relief will switch from a percentage of a mum's earned income to a fixed dollar relief from Jan 1, 2024.

Working Mother's Child Relief will switch from a percentage of a mum's earned income to a fixed dollar relief from Jan 1, 2024.

This means eligible working mothers will claim the same amount

of tax relief regardless: S$8,000 for the first child, S$10,000 for

the second and S$12,000 for the third and others to come after.

This will be more beneficial to lower-income earners than high-income

earners. However, high-income earners may get lesser relief as a result. The change will NOT apply to children born before 1 Jan 2024.

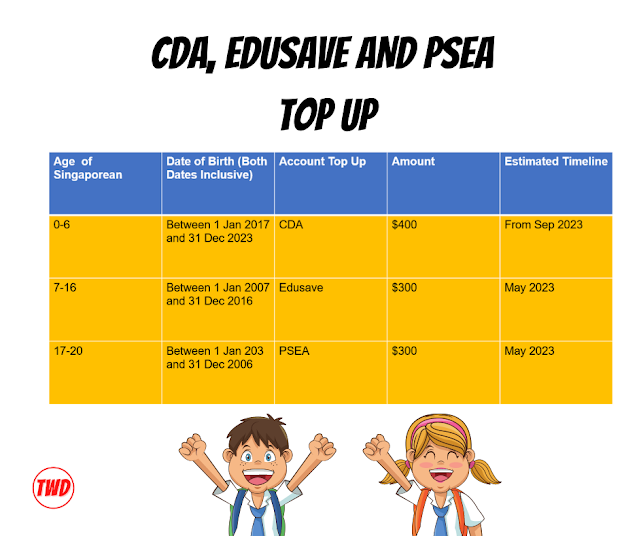

CDA, Edusave and Post Secondary Education Top Ups

Each child aged six and below will get a top-up of S$400 to their Child

Development Account. In addition, each older child will get a top-up of S$300 to

their Edusave or Post-Secondary Education accounts.

FOR FAMILIES WHO ARE EXPECTING NEW ADDITIONS

Baby Bonus Cash Gift (BBCG)

Currently, BBCG is set at up to $10,000 for parents of eligible children. This will increase by $3000 for eligible Singapore children in all birth orders. It will apply to Singaporean children born on or after 14 Feb and disbursed from early 2024.

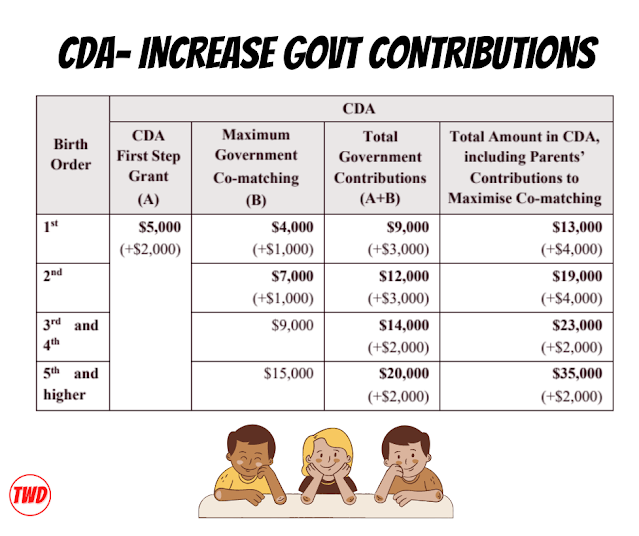

Increased in Government contributions to Child Developed Account

This is done by increasing the First Step Grant and Co-Matching Cap for Eligible Singaporean Children born on or after 14 Feb 2023.

Government contributions to the Child Development Account - used to help with preschool and healthcare expenses - will increase from S$3,000 to S$5,000 for the First Step Grant and by S$1,000 in co-matching caps for how much parents save for each child.

Government contributions to the Child Development Account - used to help with preschool and healthcare expenses - will increase from S$3,000 to S$5,000 for the First Step Grant and by S$1,000 in co-matching caps for how much parents save for each child.

Extend Baby Support Grant

The one-off Baby Support Grant of S$3,000 for children born from Oct 1, 2020, to Sep 30, 2022, will also be extended to kids born from Oct 1, 2022, to Feb 13, this year.

The one-off Baby Support Grant of S$3,000 for children born from Oct 1, 2020, to Sep 30, 2022, will also be extended to kids born from Oct 1, 2022, to Feb 13, this year.

Double Government Paid Paternity Leave (GPPL)

The government will double GPPL from 2 weeks to 4 weeks on a voluntary basis. Employees who are ready to grant up to two weeks of additional GPPL to employees will be reimbursed. Self-employed who have been in a particular business, trade, or profession for a continuous period of 3 months before their Singapore child is born are also eligible. This will apply to Singapore children born on or after 1 Jan 2024

Extend unpaid Infanr Care Leave

Unpaid infant care leave in the child's first two years will go up from six days a

year to 12.

For families with older folks

Cost of Living (COL) Senior's Bonus (June 2023)

All eligible senior Singapore Citizens aged 55 years and above

with AI, not more than $34,000 and whose residential address is a

property with an AV that does not exceed $21,000 and who do not

own more than 1 property will receive cases between $200 to $300

in June 2023.

For those planning A FIRST TIME HOME

BTO BOOST

Families with children and married couples aged 40 and below.

From later this year, these groups will get an extra ballot for their Build-to-Order (BTO) flat applications, among other measures to help them reach their keys quicker.

Resale Market: Increase in CPF Housing Grant

Increase the Central Provident Fund (CPF) Housing Grant by S$30,000 to S$80,000 for eligible first-timer families buying 4-room or

smaller resale flats.

For those buying 5-room or larger ones, their grant will go up by S$10,000

to S$50,000. They should not earn more than $14,000 a month and do

not own any private property. The additional grants will be credited in CPF from

Apr onwards.

Start Date: Feb 14 2024, from 3.30pm.

Disclaimer

While TWD strive to provide as accurate information as possible, there may be the occasional errors, do refer to official sources for confirmation

.png)

No comments