CPF Retirement Sum Guide : How much do you need at 55?

Turning 55?

Almost everyone has a CPF account. When one turns 55, a Retirement Account will be created. The retirement account will comprise savings from Special Account first, followed by an Ordinary account up to Full Retirement Sum (FRS).

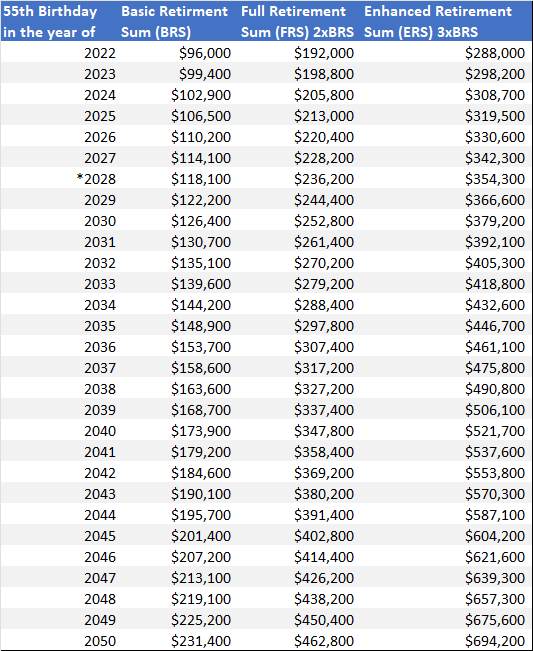

The final amount will be used to join CPF Life, to provide Lifelong Income For the Elderly (LIFE). The Retirement Sum will be adjusted yearly, and this is the projection till 2050*

SEVEN Facts you might not know about Retirement sums

2 You do not need to sell your property if you fail to meet BRS.

There is no need to top up the shortfall in cash. Any existing amount in RA will be for the retirement sum, and you will still receive a pro-rated payout.

3 You can withdraw funds at 55 even if you do not meet BRS

If you have $5000 or less in SA and OA, you can withdraw $5000 from age 55. If you have savings in RA subsequently ( through employment), you will receive payouts from what you have set aside in retirement sum from age 55.

If you have more than $5000 but less than BRS in RA, you can withdraw $4000 from age 55. Monthly payouts will still be provided from the balance in Retirement Sum from 65.

4 If you own a property (e.g. HDB), you can choose to withdraw amounts above BRS

The property will be pledged as part of the retirement account. If you sell your property AFTER 55, you need to top up your RA to the Full retirement sum first before you can withdraw any proceeds. Before 55, you can use the OA savings for purchase without this requirement.

5 You can withdraw any amount after you meet the FRS at 55

Contrary to hearsay, you can withdraw any amount in the RA above FRS when you turn 55.

6 Delay your payouts, and they will increase by 7% annually

There is no need to start the payout at 55. If you choose to wait, you will get a 7% payout increase for every year you wait

7 You can still keep your OA for housing loan after 55

If you have excess in OA after the FRS, you can keep it to pay for your housing loan.

Would you have enough for retirement?

Retirement planning should start today. However, given that the average lifespan of Singaporeans has increased, it would be better to be prudent in the longer run. While it may be tempting to withdraw all the funds and enjoy a windfall at 55, it may be better to keep more in CPF for a larger payout from 65.

*Projection is from 2028. Figures before 2028 are based on CCPF'sofficial estimation. Based on the estimate, the CPR retirement sum is projected to increase by $100 annually.

No comments