Best Fixed Deposit Rates November 2023 Singapore Banks

Are Singapore FD rates going up for Nov 2023?

Interest rates are slowly trending upward for T Bills. Would this be reflected for Banks FD?

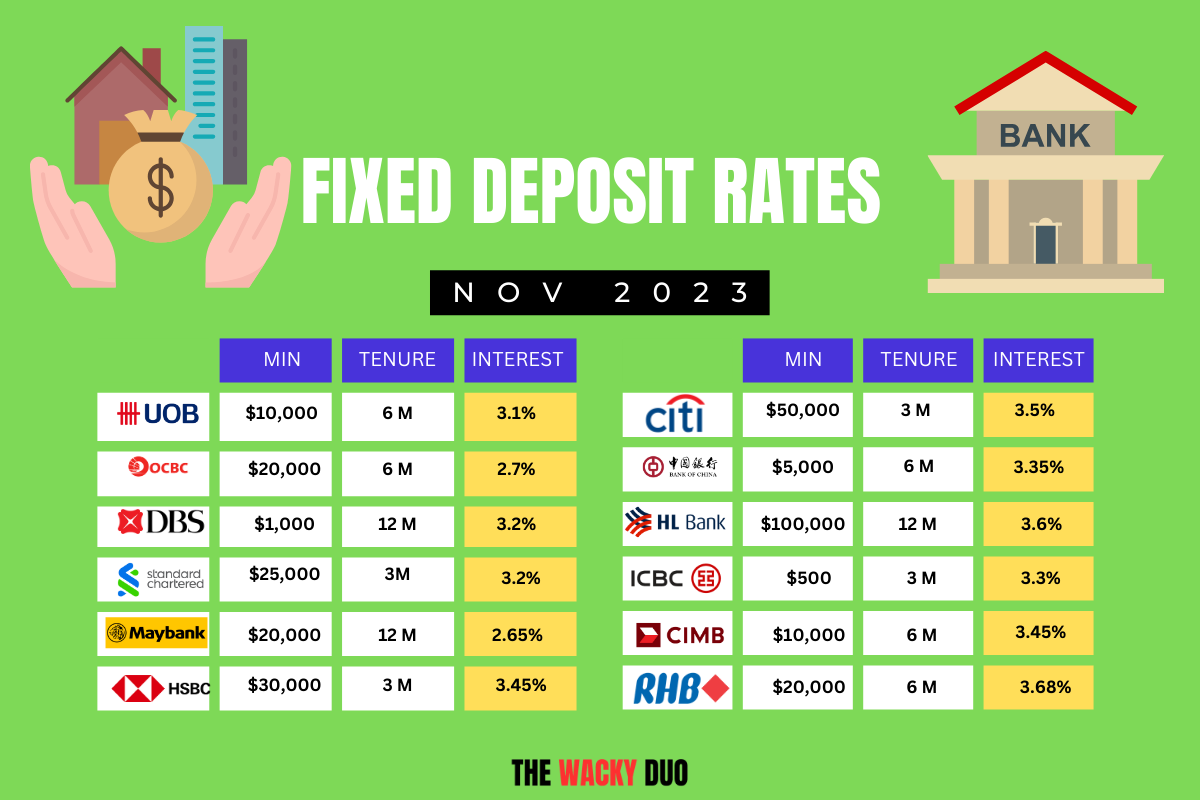

These are the best interest rates for fixed deposits for banks in Singapore for November 2023.

|

BANKS |

INTEREST (PA) |

TENURE |

MIN DEPO |

|

|

3.35% (Online) |

3 mths |

$5,000 |

|

|

3.45% (Online) |

6 mths |

$10,000 |

|

|

3.5 % (Citigold)

|

3 mths |

$250,000 |

|

|

3.2%

|

12 mths |

$1,000 |

|

|

3.6%

|

12 mths |

$100,000

|

|

|

3.58%

|

8 mths |

>$50,000 |

|

|

3.45%

|

3 mths |

$200,000 |

|

|

3.3%

|

3 mths |

$500

|

|

|

2.65% |

12 mths |

$20,000 |

|

|

2.7% |

6 mths |

$20,000

|

|

|

3.68%

|

6 mths |

$20,000 |

|

|

NA

|

NA

|

NA |

|

|

3.2 % (Priority)

|

12 mths |

$25,000 |

|

|

3.1% |

6,10,12 mths |

$10,000

|

The information provided by TWD is for information purposes. It is not meant to be personalised investment advice. Readers must do their due diligence and refer to financial advisors for their investment needs. The information is correct as of 30th Oct. . Do refer to the individual banks for the latest updates.

.png)

.svg.png)

.png)

No comments