FD, SSD or T-Bills: Where to park $100,000

Interest rates are at a very attractive level now.

With Singapore battling inflation, interest rates have soared almost 300% since the start of the year. At the beginning of 2022, 1% return is the norm. Today. We are at more than 4% for selected investment instruments.

That brings us to the question - Where should I invest if I have $100,000?

Before we answer the question, let's add a qualifier. The investments proposed should not lose their principal values over time, and the returns are guaranteed. That would rule out investments such as shares, investment link insurance, crypto, property, art, watches and even that Birkin bag.

If we explore Singapore's financial landscape today, only 3 investments stand out.

- Singapore Fixed Deposit

- Singapore Savings Bonds (SSB)

- Singapore T Bills.

For a full detailed explanation of each of the products, refer to our post here " Fixed Deposit vs Singapore Savings Bonds vs T- Bills "

Singapore Fixed Deposit

|

| Source: CIMB |

The highest rate for 100K would be at 3.9% over 18 months. This rate is from CIMB bank.

Why should you place your money in fixed deposit?

- Interest is guaranteed for 18 months. No reinvestment risk compared to T bills.

- No opportunity cost compared to T bills

- Higher first year compared to SSB

- Can accommodate a large amount

Potential Downside

- Should interest rates increase, T-bills will be more attractive.

- Deposits are guaranteed for up to $75,000 per depositor per bank

- An early break of FD may result in no interest and in some cases penalty

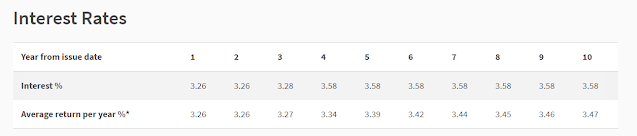

Singapore Savings Bonds

|

|

Source: MAS |

- Guaranteed by Singapore Govt

- Average return over 10 years at a high of 3.47%. No Reinvestment risk.

- Flexibility to withdraw at any time with accrued interest

- Only need $1000 to invest

- Should interest rate increase, FD and T bills will be more attractive, especially for year 1

- May not be able to invest $100,000 at once due to limited supply. Previous issues average about 10K per issue.

- Interest cannot be automatically compounded.

- Highest interest rates when compared to Fixed Deposit and SSB

- Short term duration

- Able to dictate the minimum rates

- It can accommodate large amounts

- Can use SRS and CPF

- Only need $1000 to invest

- Reinvestment risk - Might reinvest at a longer rate for the next tranche, impacting overall returns.

- Potentially lose up to 2 months of interest for CPF and 1-month interest for Cash. This will bring down overall interest.

- It may not be suitable for less sophisticated investors

- Low liquidity and may end up lost if redeemed early

- Hassle to invest if use CPF. Need CPF-IS account and apply in person at the branch

Disclaimer

The information provided by TWD serves is for educational purposes. It

is not meant to be personalised investment advice. Readers must do their

due diligence and refer to financial advisors for their investment

needs. The information is correct as of 28 Oct.

.png)

No comments