Are property prices set to fall ? Jalan Tembusa GLS Site tendered for 20.8% lower than last done in D15

Is this a sign that property prices will halt or even drop soon?

Higher bids for GLS land have driven up property prices for new launches, leading to record-breaking launch prices. The recent bid for the Jalan Tembusu GLS site indicates a shift in the trend for new launch property prices in Singapore, particularly in D15. If you're considering buying a new launch property, it's essential to be aware of this development.

District 15 : A Case Study

D15 has always been a sought-after place to live and invest due to its attractive lifestyle options. With the upcoming Thomson East Coast line starting in 2024, there's growing excitement about the improved connectivity in D15. The area offers a charming residential choice with various amenities, including East Coast Beach for leisure, East Coast Road Eateries for food, Joo Chiat Road for Peranakan culture, malls like Parkway Parade and i12 Katong for shopping, and excellent schools like Kong Hwa Primary, Haig Girls, Victoria School, and Dunman High that attract families to the region.

%20high%20res.jpg)

|

| Grand Dunman was priced at $2500 ave for the launch. |

The new launches in D15 attest to this popularity, with LIV @ MB selling out 75% of the units on launch in 2022. Despite cooling measures in 2023, Tembusu Grand still managed decent sales of 53% and the latest Grand Dunman selling out 54% on day 1 of launch with an average price of 2500psf

While the sales are healthy, the reality hits the developers. With sales of new launches seemingly taking longer to sell, it equates to higher risk, especially since developers would incur a 40% ABS charge if they are unable to complete and sell the entire project within 5 years.

The latest GLS sale of Jalan Tembusu supports this theory.

Jalan Tembusu Site 1 : Jan 2022 (TEMBUSU GRAND)

Tenderer: CDL Triton Pte Ltd

Tendered Sale Price $PSM: 14,017.41

Average Selling Price at Launch: $2465

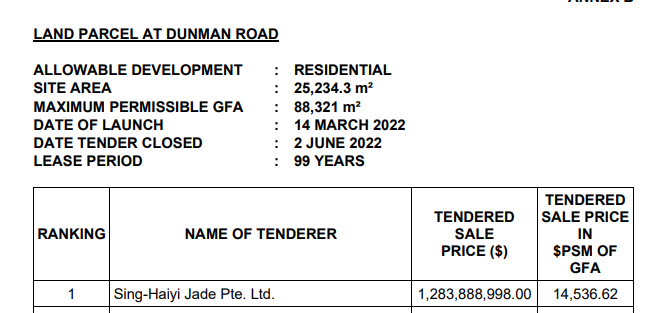

Dunman Road : March 2022 (Grand Dunman)

Tenderer: Sing-Haiyi Pte Ltd

Tendered Sale Price $PSM :

14,536.62 (+3.7%)

Average Selling Price at Launch: $2500

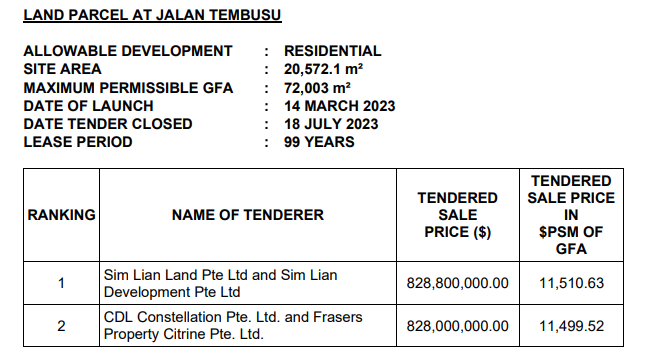

Jalan Tembusu: July 2023

Tenderer: Sim Lian Land Pte Ltd and Sim Lian Development Pte Ltd

Tendered

Sales Price $PSM: 11510.63 ( -20.8%)

Another factor for the lower bid would be the revised GFA . One of the key takeaways is to merge the definition of URA's GFA and SLA strata area. This new definition of floor area could eat into the developer's saleable area and margin as it will eliminate large air-con ledges and sale of strata void space. This effectively reduces the saleable area by as much as 5%. While a 5% drop is anticipated, a 20.8% drop is surprising.

What does it mean?

At the price Sim Lian Pte Ltd and Sim Lian Development Pte Ltd had bid for the land, the ppr is at $1069 vs Tembusu Grand of $1302 and Grand Dunman of $1350. This means that the developer have the luxury of selling the units at $2200 and making similar margins as the 2 recent new launches. This is inclusive of the reduction of 5% saleable area due to the revised GFA.

Compared to the current average price of $2450-$2500, this represents an average of 10-12% lower prices.

One of the pitch property agents like to have for new launches is that prices will head higher as GLS bid prices go higher for each round. This bid has turned this 'logic' on its head. If this is the case, would this signal lower property prices in the coming months?

Will Grand Dunman or Tembusu Grand lower the prices to clear stock before the new development for Tembusu is announced? If not, will buyers wait and see if prices will fall?

Last but not least, will this be the start of the decline in property prices?

Only time will tell.

.png)

No comments